Housing Loan Process

September 29, 2020

After publicly announcing our house, some of my friends had asked how we managed to do it. Of course we don't have millions of peso lying around ready to be used and I understand the curiosity.

When we started talking about our house, we have no idea how we can afford it, or how much is it. We figured it out little by little, so many people and available resources helped us understand. So here's an account of everything we learned.

Loan options

For the housing loan we have two options: Pag-IBIG or a bank loan. We inquired for both and we opted for a Pag-IBIG loan because:

- Requirements were less strict (required minimum salary, required lot information)

- My current house in Bacolor was loaned in Pag-IBIG 10 years ago and they are forgiving in terms of late payments

If you are opting for a bank loan, this blog post does not have enough information for it ✌🏼

FAQ, the questions we asked too

Who can get a Pag-IBIG loan? Anyone who has made contributions in Pag-IBIG who is currently employed (COE needed).

How much can I borrow? It will depend on your salary. The Pag-IBIG website has an online calculator we can use for an estimate of how much you can borrow based on your salary and how long do you want to pay for it.

What if I want to borrow more than what is allowed? You can add a co-borrower(s). It can be anyone. E.g: I could be AJ's co-borrower even though we are not related.

What are the reasons for my application to be declined? They said all applications gets approved.

How long will it take for my application gets approved? Should be 17 working days but ours took 3 months long 🤬. There were a lot of holidays November - January.

What is the process for a Pag-IBIG loan? As with our current pandemic situation, these steps might have changed.

- Attend a seminar that is available only every Friday.

- Complete initial requirements

- Apply for loan

- Complete another set of requirements after loan is approved.

- Request for release of checks

- Complete final set of requirements

- Payment for the loan starts

I am busy at work and can't find time for the seminar and requirements, what can I do? AJ's mom basically processed everything for us ✨. They required a notarised authorization and a Special Power of Attorney to allows this. However this was also a bit confusing because at first there were only a few tasks that AJ's mom can do on his behalf and they eventually allowed us to let her do everything. It might be case to case basis.

Will the loaned money be released once at 100%? The default is 30% 30% 30% 10% and every time, there's an interest we have to pay for. If they find during their inspection that the house is almost done, they can release a bigger percentage if not all. With our experience we had 15% 60% 25%. This may not be the case for those who are getting a house and lot in subdivisions or those who hired a developer to help with the processes.

Can we still change the plan after applying for the loan? Yes, until architect and client is satisfied. Our plan was even changed due to the demands for the building permit.

Is the amount of loan I set be the same amount Pag-IBIG will let me borrow? For us it was the same amount but we hear stories from others where it wasn't. One of our workmates only received the amount set for the construction, Pag-IBIG did not include the amount set for the land.

Are we going to get the full loan amount borrowed? Yes but there are deductions like stamps, taxes, interests 💸💸💸, one month advance payment, processing fees and others. We only found out about it after the approval of the second set of requirements 👻.

Initial Requirements

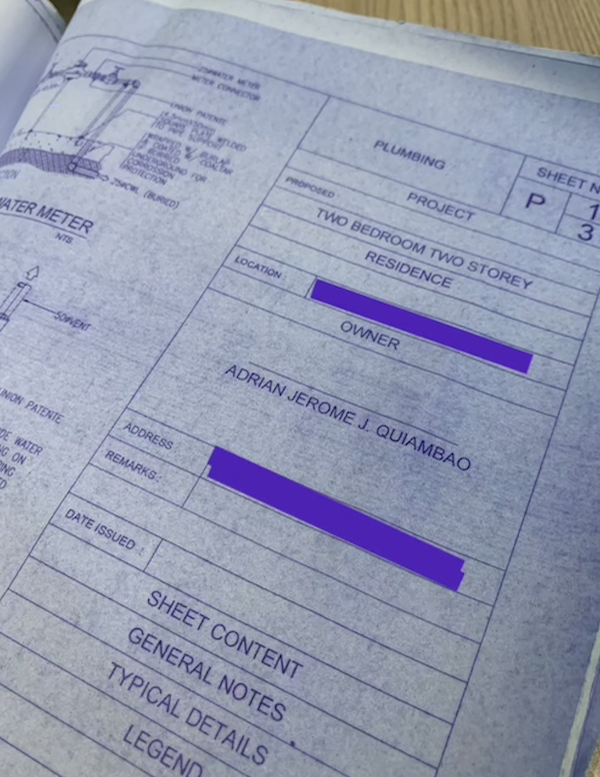

For this set of requirements it's mostly the plan of the house, legal documents of the borrower and legal documents of the land.

So this is the time to find an Architect to design your house. Their fee is typically 7-10% of the total cost of construction. This is the biggest expense that is most probably outside the money to be loaned. A lot of people will say you don't need an Architect because Engineers or Contractors can do it themselves for a cheaper price. Don't listen to that kind of noise!

I have contacted an architect bestie of mine, Ar. Iry Lising of STIL Design and Construction, to inquire about her fees and with the processes with the construction. After a few weeks we have finalized the initial plan and bill of materials that we'll use for the loan application. We had to re analyze the first plan she gave because as it turns out it was way out of our budget and we didn't want to adjust our loan amount anymore (our initial planned loan amount has doubled 👻). We adjusted our window sizes, moved and removed spaces around (some we may or may have put back eventually 😂). This was probably a time we had to adjust our expectations as well because we don't have all the money in the world 😅

Expenses to expect:

- Notaries (yes, plural)

- Signed and sealed plan, costing, vicinity map (from architect) 💸

- Professional fees

- Down payment 💸

- Pag-IBIG application (Php 3000)

Loan Application

It took us 3 times before they accepted our application because of the requirements. For this one I guess the lesson was to make sure that our Architect and the Engineers who built the plan were easy to find for them to update the documents. For some it took us weeks because it was hard to get ahold of the busy Engineers, not to mention the already busy schedule of our Architect.

When they finally accepted the application (start of November) we have automatically assumed construction will begin the following month.

Mid December we inquired about the progress and they said that it was already pre-approved but the employees were already on Christmas break 🥺And by January we tried to contact them every way we can, we called, we asked friends who has friends who works there, we inquired physically in their branch but we were really just stuck waiting for signatures. That's weeks of wasted time waiting for signatures 💆🏻♀️.

Second Set of Requirements

Again, the requirements were mostly processed by AJ's mom, and the rest that we needed from Architect Iry. This set of requirements were a lot more financially draining than the first batch (excluding the Architect's fee and down payment).

We finished acquiring the requirements in less than 2 months.

Expenses to expect:

- Notaries

- Electrical and Location plan

- BIR registration 💸

- Registry of deeds registration 💸

- Fire permit and fire extinguisher

- Building Permit

In getting the building permit, they required us to change the plan of the house. They didn't like that we have an open space 👻 that they literally crossed it out and written "delete" on the plan 👻. They also argued about the window in our second bedroom and we don't really understand why they can't see that we have already complied to all the rules (my guess is they are projecting their personal preferences) but in the end we had no choice but to follow, we needed their signatures.

Construction / Release of checks

Expenses to expect:

- Electric installation

- Water installation 💸

There were a lot of miscommunication regarding money before construction started because during the initial Pag-IBIG seminar, AJ's mother said that they encourage that we start construction because Pag-IBIG preferred that they already see a progress before accepting the application. So AJ and I thought that it wasn't required but after finishing the second set of requirements they released a document stating they will release the first check once they confirm more than 100k amount of construction already built in the lot 🤯🤯

At this point we didn't know what to do. Our Architect then decided they will use their own money from their pockets together with our down payment to start the construction 😇🙏🏼. On the other hand we drafted a letter that requests for the release of a check without their expected equity. We didn't know it was processed so we got our 15% release during the start of construction ✨.

Our construction then started March 13, 2020 which was immediately put to a stop due to the lockdown that started March 18, 2020 👻. Construction continued during MECQ after 2 months.

After the lockdown measures were eased, it was Pag-IBIG who contacted us first via text about the release of our second check. After that we communicated by email and set a date of inspection. We did not see them the day of the inspection but they said they arrived 🤷🏻♀️. They then released 60% of the total loan amount.

Last set of requirements

For the final check, we first need the occupancy permit and other requirements. The railings for our open area delayed us a little bit for this because we needed that installed first but the supplier was in Manila and they were suddenly put into a strict lockdown.

Once that was done, we passed the requirements and then they set a date in the same week for inspection. We were expecting 4 people with different purposes to check our house for that day. It was mostly okay but since we changed a lot of things as stated in the actual plan, they request an affidavit about the balcony that now takes up a bigger space. According to them, it might be an issue if the house next to us complains because we could see them from the balcony.

Expenses to expect:

- Notaries

- Signatures of Architect, Engineer, etc 💸 (this will depend on what's included in your agreement with them, for others this could be included in the initial down payment)

- Occupancy Permit

- Tax declaration

Pag-IBIG processed our last release request and we got the remaining loan balance September 30 (this last one has the most deductions 💸💸💸). And that was it! We now get to start paying monthly for this loan.

The expenses were no joke! But I want you to know, we made it without having big savings (thanks to travel, retail therapy and cravings). We saved money along the way (the lockdown due to covid19 helped a lot) and surprisingly, they had been enough. You know how they say that God will provide? It's probably the only way I could explain how we made it. 🤙🏻

If you think you're ready with just enough savings and a stable income, why not?

For your dream home, and if you liked our house, don't hesitate to contact STIL Design and Construction! And that's not just because our architect is a friend! ⭐️⭐️⭐️⭐️⭐️

Watch our house tour! 🙈

PREV

NEXT

loading

loading

Hello, your viewport is too small. ☹️